Trading & investing both involve

looking for profit in the market, but they follow that objective in

diverse ways. Both traders and investors look for profits via market

participation. On the whole, investors look for bigger returns over a

prolonged time span via buying & holding. Whereas, traders take

benefit of both rising & falling markets to enter and exit positions

over a shorter time span, taking smaller, yet more regular profits.

Here are a few major differences between stock trading and investing on the TSX:

Period:

Trading is a procedure of holding stocks

for a shorter time span. It could be for one week or more often a day!

Trader holds stocks till the short term high performance while,

investing is a way that works on buy & hold approach. Investors

invest their wealth for longer period. Temporary market vacillations are

irrelevant in the long-term investment approach.

Capital growth:

Traders keep an eye on the price

fluctuation of stocks. It the cost goes higher, they are likely to sell

the stocks. Simply said, trading is a skill of timing the stock market

whilst investing is a skill of making money by compounding interest

& dividend over the years by holding profitable stocks.

Risk:

No doubt, both investing and trading

comes with risk. Nevertheless, trading relatively comes with higher risk

& higher prospective returns as the stock price might go high or

low inside short time span. Since investing is a skill, you need some

time to develop it. It encompasses significantly lower risk & lower

returns in short-term basis but can deliver higher return if held for a

longer span of time. Everyday market cycles don’t affect a great deal on

top-quality stock investments for an extended period of time.

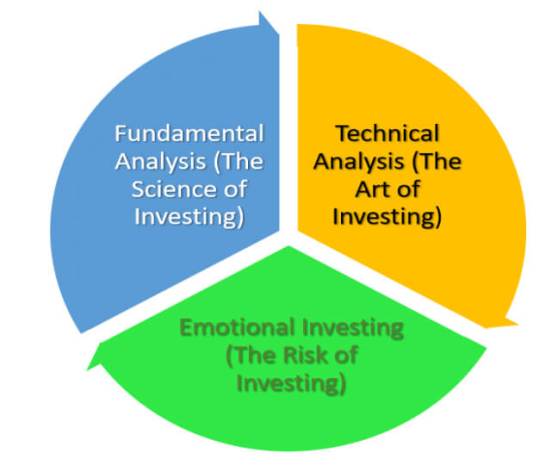

Art vs. skill:

Traders are skilled individuals who time

the market & study market trends to get higher profits in the set

time frame. It’s associated to the psychology of the market. On the

other hand, investors evaluate the stocks they wish to put their money

on. Also investing encompasses learning business basics & pledge to

stay invested for a long period of time. It’s associated to the values

that run the business.

Are you interested on getting more in-depth knowledge on stock trading and investing on the TSX?

If yes, then feel free to join Train2Invest program right now! We’d

love to make you a reasonable player in the stock trading and investing

arena.

Comments

Post a Comment